Kuda Bank: Revolutionizing Banking in Africa Through Digital Innovation

In the dynamic landscape of African fintech, Kuda Bank has emerged as a trailblazer, reshaping traditional banking through its digital-first approach. This comprehensive news article delves into the roots, growth, and impact of Kuda Bank, exploring how it is transforming the banking experience in Africa.

The Genesis of Kuda Bank:

Founded in 2019 by Babs Ogundeyi and Musty Mustapha, Kuda Bank was established with a vision to address the challenges faced by Africans in accessing and using banking services. Recognizing the potential of mobile technology, the founders set out to create a banking platform that caters to the digital needs of the continent.

Digital-First Banking:

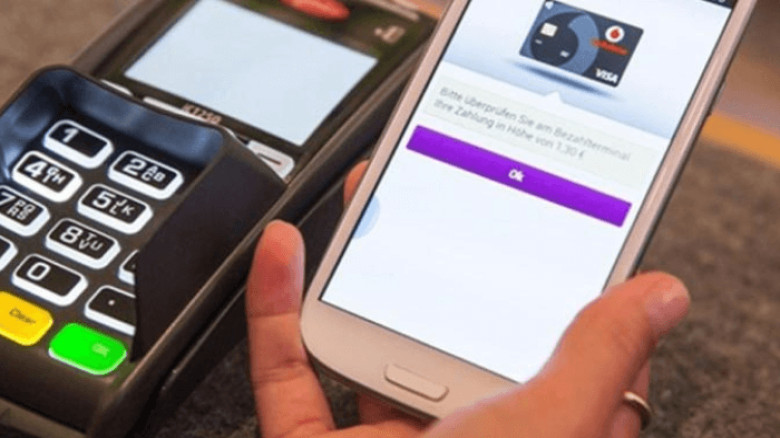

1. Mobile-Only Approach: Kuda Bank operates exclusively through a mobile application, eliminating the need for physical branches. This approach aligns with the widespread adoption of smartphones in Africa and ensures that banking services are accessible to a broader population.

2. Customer-Centric Design: The Kuda app is designed with a user-centric focus, providing a seamless and intuitive interface. Users can open accounts, make payments, and manage their finances with ease, reducing the friction often associated with traditional banking.

3. Financial Inclusion: Kuda Bank aims to bridge the gap in financial inclusion by offering banking services to the unbanked and underbanked populations. Through its mobile platform, it provides a gateway to essential financial services for individuals who may not have had access before.

Key Features and Services:

1. Zero-Fee Banking: Kuda Bank distinguishes itself by offering zero-fee banking services. Users can make transactions, including transfers and withdrawals, without incurring traditional banking fees.

2. Automated Budgeting: The app includes tools for automated budgeting, helping users manage and track their spending. This feature aligns with Kuda's commitment to promoting financial literacy.

3. Instant Notifications: Real-time notifications keep users informed about their account activities, enhancing transparency and security.

Growth and Funding:

1. Investor Confidence: Kuda Bank has garnered significant attention from investors, securing funding rounds that underscore the confidence in its innovative model. Notable investors include Sequoia Capital, Target Global, and SBI Investment.

2. Expanding Market Presence: Initially launched in Nigeria, Kuda Bank has expanded its market presence. The bank is actively exploring opportunities to extend its services to other African countries.

Challenges and Future Outlook:

1. Regulatory Landscape: Operating in a complex regulatory environment, Kuda Bank navigates challenges associated with compliance and regulatory changes.

2. Competition and Collaboration: The fintech space in Africa is competitive, with several players vying for market share. Kuda Bank seeks to differentiate itself through innovation and strategic collaborations.

Conclusion

Kuda Bank's journey symbolizes the transformative potential of fintech in Africa. By leveraging digital technology and prioritizing financial inclusion, Kuda is not merely a bank; it is a catalyst for change in the way Africans experience and engage with banking services. As it continues to grow, Kuda Bank is poised to leave an indelible mark on the future of banking in Africa.

Kuda Bank offers its customers a convenient and fee-free alternative to traditional banking. With Kuda, users can open an account within minutes, track their spending, save more, and make the right money moves. Kuda also provides zero maintenance fees, free transfers, low-cost transfers to Nigeria, automatic savings and investments, and short-term loans.

Kuda Bank aims to be the money app for Africans, regardless of who they are and where they live. It leverages technology to provide financial inclusion and empowerment to millions of people who are underserved or excluded by the conventional banking system. Kuda also partners with other fintech companies and platforms to offer its customers access to a wide range of services and products.

Kuda Bank has been growing rapidly since its inception, attracting over 1.4 million users and raising over $60 million in funding. It is also expanding its operations to other African countries, such as Ghana, Kenya, and South Africa. Kuda Bank is on a mission to revolutionize the banking industry in Africa and beyond.

Leave A Comment