Nigeria to launch its first regulated Naira stablecoin in February

Nigeria is set to launch its first regulated Naira stablecoin, cNGN, in February 2024, following the lifting of a two-year ban on cryptocurrency transactions by the Central Bank of Nigeria (CBN).

The cNGN stablecoin is a digital token that will be pegged 1:1 to the Nigerian Naira and backed by the reserves of the participating banks. The stablecoin will be developed and managed by the Africa Stablecoin Consortium (ASC), a collaboration of Nigerian banks, fintechs, and blockchain businesses.

The cNGN stablecoin aims to bridge the gap between the Naira and the global digital currencies, as well as to facilitate cross-border payments, remittances, and e-commerce. The stablecoin will also comply with the regulatory standards set by the CBN and other stakeholders.

The cNGN stablecoin will be built and executed on an African blockchain that will be launched in January 2024. The blockchain will enable interoperability with other public blockchains, allowing the stablecoin to expand its utility beyond Nigeria.

The cNGN stablecoin will debut on February 27, 2024, according to Forbes. The stablecoin will be serviced by the ASC and owned by its banks. The ASC will also provide education and awareness campaigns to promote the adoption and use of the stablecoin.

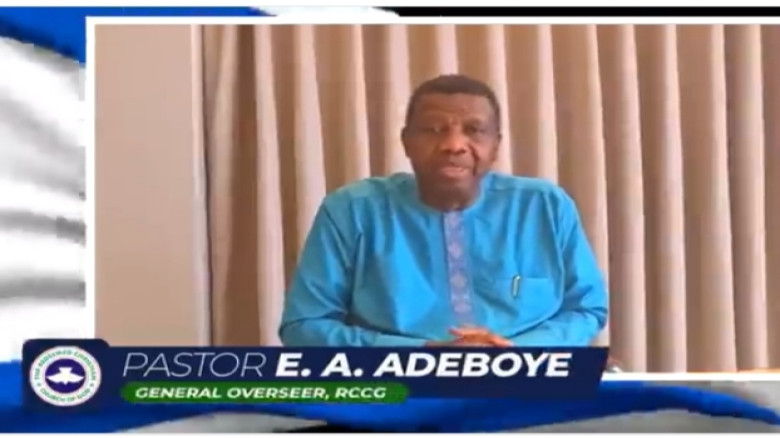

The launch of the cNGN stablecoin comes after the CBN lifted the ban on crypto transactions in Nigeria on December 22, 2023. The CBN had imposed the ban in February 2021, citing the risks and challenges posed by cryptocurrencies to the financial system and the economy.

The ban had affected many crypto businesses and users in Nigeria, forcing them to use alternative channels or platforms. Nigeria is one of the fastest-growing and largest crypto markets in Africa, with over $400 million worth of crypto transactions in 2020, according to Chainalysis.

The CBN said that it decided to lift the ban after recognizing the need to regulate the activities of crypto companies following the prevailing global trends. The CBN also said that it will issue guidelines and frameworks for the licensing and operation of crypto service providers in Nigeria.

The cNGN stablecoin is different from the eNaira, a central bank digital currency (CBDC) that the CBN launched in October 2021. The eNaira is a digital representation of the Naira that is issued and controlled by the CBN. The eNaira is meant to enhance financial inclusion, improve payment efficiency, and support the digital economy.

However, the eNaira has seen minimal adoption and usage since its launch, due to various factors such as technical glitches, low awareness, and lack of incentives. Some analysts have also argued that the eNaira is not a true digital currency, as it does not offer the benefits of decentralization, transparency, and innovation that cryptocurrencies provide.

The cNGN stablecoin, on the other hand, is a cryptocurrency that will leverage the advantages of blockchain technology, such as security, speed, and scalability. The cNGN stablecoin will also offer more flexibility and choice to the users, as they can switch between the Naira and the stablecoin at any time.

The cNGN stablecoin is expected to boost the crypto ecosystem and the digital economy in Nigeria, as well as to enhance the competitiveness and relevance of the Naira in the global market. The cNGN stablecoin will also showcase the potential and innovation of the African blockchain and fintech sector.

Leave A Comment